By merchantservices December 8, 2025

Multi-currency payments for global stores have moved from “nice-to-have” to “must-have.” Shoppers want to browse, see prices, and pay in their own currency without doing mental math or worrying about surprise fees.

At the same time, merchants want to grow international revenue, reduce cross-border costs, and keep operations simple. Modern payment platforms, new real-time networks, and even stablecoins are reshaping how multi-currency payments for global stores work, making it easier than ever to sell worldwide while getting paid efficiently in your base currency.

This in-depth guide explains what multi-currency payments for global stores really are, how they work behind the scenes, how to implement them, and how to future-proof your strategy. You’ll learn how to optimize conversions, manage FX risk, avoid hidden fees, and prepare for coming trends like real-time payment rails, stablecoins, and central bank digital currencies (CBDCs).

What Are Multi-Currency Payments for Global Stores?

Multi-currency payments for global stores describe the ability of an online or omnichannel store to display prices, accept payments, and settle funds across multiple currencies. Instead of forcing every buyer to pay in a single “store currency,” the store supports a range of currencies aligned with shoppers’ locations and preferences.

In practice, multi-currency payments for global stores mean that a shopper in one region can see product prices in their local currency during browsing, at checkout, and in post-purchase communication.

The checkout, payment gateway, and acquiring bank work together so that the customer’s card or wallet is charged in their currency, while the merchant may settle funds in that currency or convert them into a home currency depending on configuration.

Multi-currency payments for global stores go beyond simple currency “labels.” They involve real-time or near-real-time exchange rate sourcing, FX markups or spreads, and logic that determines how much to charge, how much to convert, and how much to keep in different currency balances.

Advanced setups also integrate multi-currency payouts to suppliers or marketplaces, localized payment methods, and cross-border tax and compliance handling.

As multi-currency payments for global stores evolve, they increasingly rely on specialized providers that offer localized pricing and multi-currency processing as built-in features of their ecommerce tools.

Leading commerce and payment platforms highlight that multi-currency pricing is now a core component of cross-border growth strategies, not just a technical add-on.

How Multi-Currency Payments Work in Modern Ecommerce

Under the hood, multi-currency payments for global stores combine front-end localization and back-end payment infrastructure. On the front end, geo-IP data, browser language, or explicit customer selection determines which currency the shopper sees.

On the back end, payment gateways and acquirers route the transaction through schemes and banking partners capable of processing that currency, while FX engines set the effective exchange rate.

When a shopper checks out, a few key things happen. First, the store determines a display currency and a billing currency. In true multi-currency payments for global stores, these are the same: the amount shown to the shopper is the amount billed to their card or wallet in that currency.

The payment processor then converts funds to the merchant’s preferred settlement currency later or holds balances in multiple currencies to be converted in bulk.

Modern platforms for multi-currency payments for global stores often support local acquiring in key markets. This can reduce cross-border fees, improve authorization rates, and ensure that transactions are treated as domestic rather than cross-border where possible.

Cross-border fees and FX costs can otherwise consume 2–5% of international revenue, which is why merchants are motivated to optimize how multi-currency payments are routed.

To manage risk, multi-currency payments for global stores are backed by rules engines and fraud tools that understand local card behavior, 3D Secure or similar authentication flows, and local payment regulations.

The result is a system where shoppers feel at home in their own currency, while the merchant maintains centralized control over FX, reconciliation, and treasury.

Multi-Currency Pricing vs. Dynamic Currency Conversion (DCC)

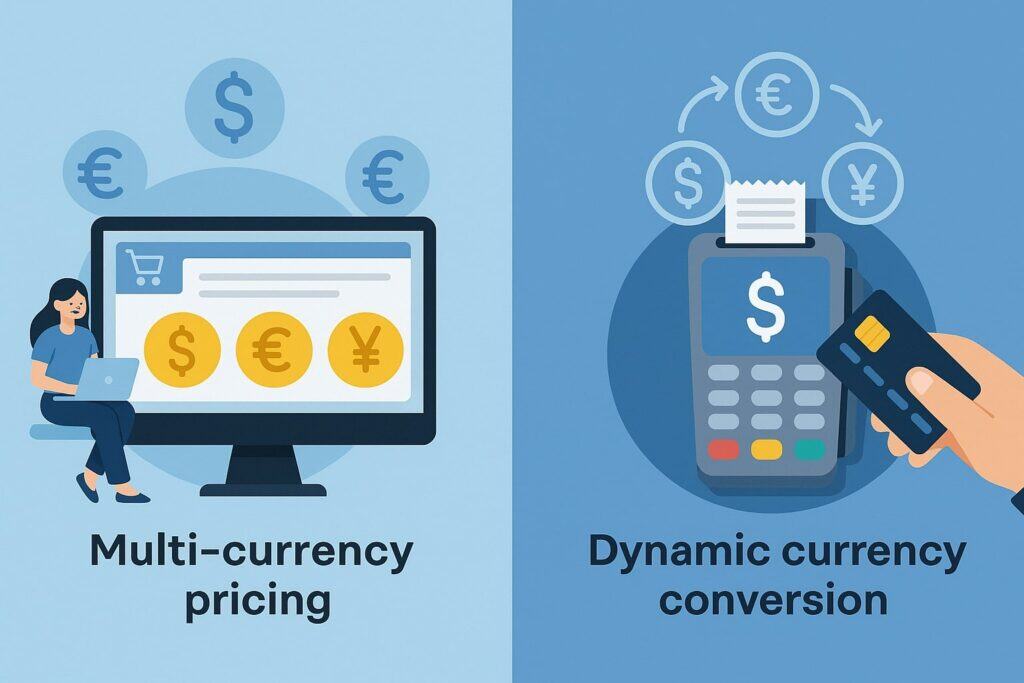

It’s important to distinguish multi-currency pricing from dynamic currency conversion (DCC) when designing multi-currency payments for global stores. Both allow shoppers to pay in their home currency, but they work very differently and have very different impacts on user experience and cost.

With multi-currency pricing, the merchant sets and displays prices in the customer’s currency at the storefront level. The shopper never sees a foreign currency; the store controls the exchange rates, markups, and price rounding.

This model is central to multi-currency payments for global stores because it aligns pricing, marketing, and customer expectations with localized currencies.

With DCC, the card terminal or online payment processor offers the shopper a choice to pay in their card’s home currency while the merchant prices in another currency. The conversion is performed by the processor or acquirer at checkout, typically with a higher markup.

Multiple consumer-focused guides warn that DCC often leads to worse exchange rates for shoppers, effectively inflating prices even if the merchant doesn’t see a direct hit.

For multi-currency payments for global stores, multi-currency pricing is usually superior to DCC. It lets merchants control the FX spread, keep pricing consistent, and avoid unpleasant surprises for customers.

DCC can still play a role in some card-present scenarios or legacy setups, but most modern global stores favor multi-currency pricing embedded into their ecommerce platform over pass-through DCC at the payment layer.

Why Multi-Currency Payments Matter for Global Stores

Multi-currency payments for global stores directly influence how international shoppers perceive your brand and whether they complete a purchase.

When a customer sees familiar currency symbols and rounded prices, they feel they are buying from a local, trustworthy business. When they see foreign currencies and ambiguous amounts, they hesitate, do mental math, and often abandon their carts.

For merchants, multi-currency payments for global stores touch every metric that matters: conversion rate, average order value (AOV), refund and chargeback rates, and net profit after fees.

They also determine whether expansion into new markets is sustainable. If cross-border FX spreads, scheme fees, and processing costs eat into margins, merchants may think global expansion “doesn’t work,” when in fact a better multi-currency strategy would unlock profitability.

Research and reports from major commerce platforms emphasize that offering localized currency pricing and multi-currency payments can materially increase international conversion rates by reducing friction and uncertainty.

For shoppers, knowing the exact amount they will be charged in their own currency—without hidden FX fees—builds trust and encourages larger baskets and repeat purchases.

In a competitive landscape where shoppers can switch tabs and find alternatives in seconds, multi-currency payments for global stores are a powerful differentiator. They can transform a generic, foreign-feeling storefront into a localized, familiar experience that feels tailored to each region.

Impact on Conversion Rates, AOV, and Customer Trust

The biggest commercial impact of multi-currency payments for global stores is felt in conversion rates and average order values.

When customers see prices in their own currency, with clear totals including taxes and shipping, they are less likely to abandon checkout. Confusion over FX, extra bank charges, or unexpected totals is a major source of cart abandonment in cross-border ecommerce.

Multi-currency payments for global stores address this by building transparency into the shopping journey. If a shopper never needs to open a currency converter or guess how their bank will convert the charge, their mental load drops, and their likelihood of completing the purchase rises.

Better still, localized currency pricing allows merchants to test price points that align with local expectations rather than forcing one global price structure.

In addition, multi-currency payments for global stores can boost AOV. Shoppers who feel confident about what they are paying are more willing to add items to their cart or opt for premium bundles.

Transparent pricing also reduces disputes, chargebacks, and “friendly fraud” because customers can match order totals to their statements in their own currency. Platforms that analyze cross-border performance repeatedly highlight clarity of pricing and currency as a key factor in reducing fraud alerts and billing disputes.

Trust is the long-term benefit. A well-implemented system of multi-currency payments for global stores signals that your business understands and respects local customers. This supports repeat purchases, loyalty programs, and word-of-mouth growth in markets that might otherwise feel underserved.

Competitive Advantages and Brand Localization

Multi-currency payments for global stores are also a strategic branding tool. When shoppers see their local currency, region-specific payment methods, and familiar checkout flows, they perceive the brand as local—even if operations are centralized elsewhere.

This perception of localization makes it easier to compete against regional incumbents and marketplaces that already understand local norms.

By embracing multi-currency payments for global stores, merchants can tailor pricing strategies to local income levels, taxes, and expectations. They can use rounded psychological price points, account for local sales taxes, and factor in duties and customs where applicable.

Rather than offering a one-size-fits-all global price, the merchant can calibrate revenue and margin per market.

Competitively, multi-currency payments for global stores help smaller merchants punch above their weight. Larger marketplaces and global platforms already invest heavily in local acquiring, FX optimization, and payment method localization.

By using modern payment providers, even mid-market stores can access similar capabilities and offer local currency pricing in dozens of markets without building the infrastructure in-house.

Finally, multi-currency payments for global stores strengthen partnerships with influencers and affiliates in different regions. When partners promote prices in a local currency that matches the landing page and checkout, conversion from these campaigns improves, making performance marketing more efficient and scalable.

Key Components of a Multi-Currency Payment Stack

Underneath the surface of multi-currency payments for global stores sits a multi-layered payment stack. This stack is responsible for routing payments, performing FX conversions, handling settlement, managing risk, and reconciling everything back into financial systems and accounting.

At a high level, multi-currency payments for global stores rely on:

- Payment gateways and processors that can accept and route many currencies.

- Acquiring banks or provider relationships in multiple regions.

- FX and treasury management tools that convert currencies at competitive rates.

- Fraud, risk, and compliance systems that adapt to local behavior and regulations.

- Reporting and reconciliation tools that make sense of multi-currency data for finance teams.

Each layer influences the cost, reliability, and flexibility of multi-currency payments for global stores. A store that simply flips on “multi-currency” in the front end without considering the back-end implications may see higher fees, operational complexity, or unexpected reconciliation headaches.

Payment Gateways, Processors, and Acquirers

At the heart of multi-currency payments for global stores are payment gateways and processors. These systems handle tokenization, routing, authorization, and settlement. To deliver true multi-currency support, they must be able to accept payments in many currencies and settle funds in currencies that matter to the merchant.

Multi-currency payments for global stores often benefit from local acquiring, where the acquirer is located in the same region as the cardholder.

Local acquiring improves authorization rates (because transactions look domestic rather than cross-border), reduces scheme and cross-border fees, and can support local payment methods that do not exist elsewhere.

This is particularly important for cards that impose higher interchange or cross-border fees on foreign transactions.

Gateways for multi-currency payments for global stores also need to support modern features like:

- Network tokenization to improve authorization and card lifecycle management.

- 3D Secure or similar SCA flows that respect local regulations.

- Multi-tenant routing rules, such as sending certain currencies to specific acquirers for optimal cost and success rates.

Choosing providers that are explicitly optimized for multi-currency payments for global stores can make a big difference. Some platforms treat cross-border as an edge case, whereas newer players and specialized cross-border providers design entire products around global payouts, multi-currency wallets, and localized checkout experiences.

FX Conversion, Hedging, and Treasury Management

While the front-end experience of multi-currency payments for global stores is about friendly prices and transparent totals, the back-end is about FX and treasury. Each time a shopper pays in a foreign currency, someone must hold and convert that currency. That “someone” can be the merchant, the processor, or a specialized FX partner.

If a merchant settles directly in many currencies, they will manage multiple bank accounts, balances, and cash flows. This can minimize FX fees if they pay suppliers or employees in the same currencies.

However, it increases operational complexity. Many merchants prefer to settle most funds in a single home currency, allowing the provider to manage FX conversion in the background.

For multi-currency payments for global stores, FX strategies include:

- Spot conversions at transaction time.

- Daily or periodic batching of conversions to reduce spreads.

- Hedging with forwards or options for large, predictable currency flows.

- FX markup policies, where a small spread is added to cover cost and risk.

The cost of cross-border payments and FX is not trivial. Studies show that cross-border fees, including FX spreads and banking charges, can consume several percentage points of transaction value, potentially 2–5% of international revenue if not optimized. Multi-currency payments for global stores must therefore treat FX as a strategic lever, not an afterthought.

Treasury teams should integrate payment data with forecasting tools to predict currency inflows and outflows. This allows smarter hedging decisions, better working capital management, and more accurate margin forecasting in each market.

Fraud, Risk, and Compliance in Multi-Currency Payments

Multi-currency payments for global stores operate across different regions, regulations, and consumer behaviors. This naturally increases fraud and compliance complexity.

Fraud patterns differ by region; card testing, stolen credentials, and friendly fraud may be more common in some markets than others, and local regulations may require specific authentication methods.

Effective multi-currency payments for global stores rely on adaptive risk engines that incorporate:

- Device and behavioral fingerprinting.

- Velocity and anomaly checks across currencies and regions.

- Region-specific rules for high-risk BIN ranges or IP geolocation mismatches.

- Sophisticated 3D Secure / SCA flows tailored by market.

Compliance is also critical. Multi-currency payments for global stores must meet AML and sanctions requirements, card network rules, PCI DSS standards, and local regulations related to consumer protection and data privacy.

As regulators tighten supervision of digital payments, especially cross-border flows and high-risk industries, merchants must ensure that their payment partners stay ahead of evolving regulations.

In practice, this means choosing PSPs and gateways that provide built-in compliance tooling, robust KYC / KYB processes for marketplaces and platforms, and strong reporting features.

When multi-currency payments for global stores are backed by mature fraud and compliance frameworks, they can safely scale into new markets without disproportionate risk exposure.

Implementing Multi-Currency Payments in Your Store

Implementing multi-currency payments for global stores is a strategic project, not just a settings toggle. It starts with understanding your current buyer base, target markets, and growth strategy.

Then it moves on to selecting providers, designing the customer experience, and configuring FX, tax, and operational workflows.

The goal is to align multi-currency payments for global stores with your business model: which markets generate the most traffic, where you have existing logistics capacity, and where you see the biggest opportunities for margin and growth.

From there, you can prioritize currency support, local payment methods, and marketing campaigns tailored to those regions.

Strategy and Business Case for Multi-Currency Payments

Before changing your checkout, you should build a business case for multi-currency payments for global stores. This means quantifying potential gains in conversion and revenue, and weighing them against implementation costs and fees.

Start by analyzing:

- Where your traffic and signups are coming from by region.

- Which countries show high traffic but low conversion.

- Current cross-border fees and FX spreads on existing sales.

- Customer support tickets complaining about FX fees or unclear pricing.

If you see many visitors from specific regions but relatively low completed orders, multi-currency payments for global stores can be a high-impact lever. Offering local currency and payment methods often unlocks “trapped demand” from shoppers who were interested but hesitant due to foreign currency pricing.

Next, model scenarios where multi-currency payments for global stores improve conversion by modest percentages in those markets. Even small lifts can translate into significant incremental revenue over a year. Compare that revenue to the cost of provider fees, development work, and internal processes.

In many cases, multi-currency payments for global stores pay for themselves quickly, especially if they also reduce cross-border fees through local acquiring and better FX.

Finally, consider strategic alignment. If your product has universal appeal and you want a strong presence in multiple regions, multi-currency payments for global stores are almost mandatory.

If your international traffic is limited or your product is region-specific, a phased approach—starting with the top one or two foreign markets—may be more appropriate.

Technical Integration and Checkout UX

Once the strategy is clear, the next step in multi-currency payments for global stores is technical integration and UX design. This is where you decide how currencies will be selected, displayed, and stored, and how back-end systems will handle multi-currency data.

Key decisions include:

- Currency detection: Use IP geolocation, browser locale, or explicit user choice?

- Currency selector placement: In the header, footer, or checkout step?

- Persistence: Should selected currency persist across sessions or devices?

- Rounding rules: How will you handle “ugly” converted prices?

For multi-currency payments for global stores, best practice is usually a combination of smart defaults and explicit user control. Automatically suggesting a local currency based on location or language lowers friction, while letting users switch currencies ensures flexibility for travelers, expatriates, or VPN users.

Checkout UX should ensure that the same currency appears consistently from product page to cart to checkout to confirmation. Any mismatch can confuse shoppers and damage trust.

Multi-currency payments for global stores also require clear labeling of taxes, shipping, and any applicable duties, ideally with all cost components shown in the shopper’s currency before final confirmation.

On the technical side, multi-currency payments for global stores often require:

- Updating product catalog and pricing APIs to handle multiple price sets.

- Modifying cart and checkout code to support multiple currencies and price lists.

- Integrations with payment gateways configured for multiple billing currencies.

- Back-end logic for mapping shopper currency to settlement and FX rules.

Done well, the result is a seamless experience where multi-currency payments for global stores feel natural to buyers while remaining manageable for developers and operators.

Pricing, Fees, and Margin Management

The economics of multi-currency payments for global stores are just as important as UX. Each currency comes with FX costs, scheme and cross-border fees, and potential tax differences. Ignoring these factors can erode margins even as revenue grows.

When designing multi-currency pricing, merchants must decide:

- Whether to mirror a base currency using daily FX rates plus a fixed markup.

- Whether to set market-specific price lists based on local benchmarks.

- How to handle FX volatility, including buffer margins and review cycles.

- Whether to bake estimated duties or taxes into final prices.

Cross-border fees and FX markups from banks and card networks can be substantial. Industry analyses show that cross-border FX spreads and related fees can easily total several percent of transaction value, especially when multiple intermediaries are involved.

For multi-currency payments for global stores, working with providers that offer wholesale or interbank FX rates plus low, transparent fees can deliver meaningful savings.

Margin management also involves revenue operations and finance. Multi-currency payments for global stores introduce complexity in revenue recognition, refunds, chargebacks, and accounting.

Finance teams need tools and reports that show net revenue, fees, and chargebacks by currency and market. Ideally, this data feeds into dashboards so teams can quickly spot where FX or fees are eroding profitability and adjust pricing or routing accordingly.

Multi-Currency Payment Methods and Technologies

The technology landscape behind multi-currency payments for global stores is evolving rapidly. Traditional card rails are now supplemented by real-time payment networks, alternative payment methods, digital wallets, and even blockchain-based stablecoins.

For global merchants, the challenge is choosing the right mix of methods that support multi-currency payments without overwhelming operations.

A good multi-currency strategy covers:

- Cards and digital wallets like card-on-file, tokenized cards, and big wallets.

- Local bank transfers and A2A payments via local or regional instant rails.

- Alternative methods, including BNPL, vouchers, and cash-based options.

- Emerging rails such as stablecoins and on-chain settlement.

Each method has different strengths in terms of currency support, cost, speed, and user familiarity. Multi-currency payments for global stores should prioritize methods that align with local preferences, regulatory frameworks, and conversion goals.

Cards, Wallets, Bank Transfers, and Local Payment Methods

Cards remain central to multi-currency payments for global stores, especially in mature ecommerce markets. Most international shoppers expect to pay with debit or credit cards branded by major schemes.

Supporting multi-currency card payments means configuring gateways and acquirers to accept and bill in multiple currencies, while offering local currency pricing for the shopper.

However, cards are only part of the picture. Successful multi-currency payments for global stores increasingly incorporate digital wallets and local payment methods.

In many regions, wallets and A2A payments are gaining share due to better UX and lower fees. Local bank transfers and instant payment methods often support multiple currencies via intermediaries, enabling faster settlement and sometimes lower FX costs.

Local payment methods—such as region-specific wallets, bank redirects, or cash-based vouchers—are especially important in markets where card penetration is limited. Supporting these methods in the context of multi-currency payments for global stores means:

- Surfacing familiar logos and flows during checkout.

- Ensuring the checkout total is displayed and charged in local currency.

- Integrating with providers that can handle settlement and FX behind the scenes.

Digital wallets also simplify recurring payments and subscriptions in multiple currencies. With vaulted payment tokens and intelligent routing, multi-currency payments for global stores can maintain high authorization rates and low churn for subscription businesses across borders.

Real-Time Payments, Stablecoins, and Emerging Rails

The future of multi-currency payments for global stores is tightly connected to real-time payment networks and digital assets like stablecoins.

Cross-border payments have historically been slow and expensive due to correspondent banking and legacy messaging systems. Now, real-time and next-generation rails are emerging to fix these pain points.

Industry reports highlight the rapid growth of cross-border payment volumes and emphasize that technologies like real-time rails, AI, and new messaging standards are transforming how money moves globally.

At the same time, stablecoins are demonstrating that they can reduce cross-border payment costs from typical ranges of 3–6% to near-zero levels in some cases, while enabling 24/7 settlement.

For multi-currency payments for global stores, this means:

- Real-time settlement of payouts to sellers, contractors, or affiliates in multiple currencies.

- Potential for on-chain FX routing, where funds move via stablecoins and are converted to local currencies at the edges.

- Lower liquidity and working capital requirements because funds can move faster and more predictably.

Fintechs and large payment companies are actively experimenting with these models, including issuing their own payment-focused stablecoins and partnering on cross-border pilots.

In time, multi-currency payments for global stores may increasingly rely on a mix of traditional acquirers, real-time domestic rails, and blockchain-based settlement layers that dramatically reduce FX and cross-border fees.

Optimizing Multi-Currency Payments for SEO and User Experience

Because multi-currency payments for global stores live at the intersection of payments, UX, and marketing, they have a direct impact on SEO and conversion optimization.

Search engines look closely at user behavior: bounce rates, time on site, and conversion signals. Unclear pricing or currency mismatches can push users away, hurting both rankings and revenue.

Optimizing multi-currency payments for global stores involves aligning currency, content, and customer expectations.

When shoppers find your site through localized queries and see prices and payment methods tailored to their region, they are more likely to engage deeply, convert, and return. These positive user signals help search engines interpret your site as relevant and user-friendly.

Currency-Specific Content, SEO, and CRO

One key way to optimize multi-currency payments for global stores is to align currency with localized content and SEO strategy. Instead of a single generic site that shows different currencies, consider:

- Localized landing pages with region-specific currency, shipping details, and promotions.

- Clear mention of accepted currencies and local payment methods in on-page content.

- Schema markup for offers and prices that reflects local currency codes.

Multi-currency payments for global stores benefit from content that reassures users about total cost transparency. Explain how FX is handled, whether there are any additional bank fees, and confirm that customers pay and are billed in their chosen currency. This reduces friction for search visitors who land on PDPs or category pages and want immediate clarity.

On the CRO side, multi-currency payments for global stores should be A/B tested. Experiments can include:

- Default vs user-selected currencies.

- Different locations and designs for currency selectors.

- Different price rounding strategies.

- Copy that emphasizes “no hidden FX fees” or “pay in your currency.”

By treating multi-currency payments for global stores as part of your SEO and CRO toolkit, you can improve both organic performance and paid campaign efficiency, especially when targeting international audiences.

Analytics, Reporting, and Tax Considerations

Multi-currency payments for global stores generate multi-dimensional data. To make sense of it, you need analytics and reporting that break down performance by currency, market, and payment method.

Only then can you truly understand which combinations of currency and method drive the best conversion and profitability.

Analytics for multi-currency payments for global stores should track:

- Conversion rates by currency and by region.

- Average order value and discount impact in each currency.

- Fee structures, chargebacks, and refunds by currency and method.

- Lifetime value of customers who first purchased in different currencies.

Tax and compliance considerations are also crucial. Multi-currency payments for global stores often intersect with VAT, GST, or sales tax rules that vary by jurisdiction.

Some markets require that tax amounts are displayed clearly in local currency, or that invoices show specific breakdowns. Your tax engine should be fully integrated with your multi-currency pricing system so that taxes are calculated and shown correctly in each currency.

Finance and accounting teams must handle multi-currency reconciliation, including FX gains and losses, tax liabilities, and regulatory reporting. Selecting payment partners that provide detailed transaction and fee reports, and integrating them with accounting tools, is essential for smooth operations.

By investing in analytics and tax-aware systems, multi-currency payments for global stores become not just a customer-facing feature but a robust, auditable financial framework.

Common Challenges in Multi-Currency Payments and How to Avoid Them

Even with strong tools, multi-currency payments for global stores come with real challenges. Exchange rate volatility, hidden fees, technical complexity, and regulatory constraints can create friction for both customers and internal teams. The good news is that many of these challenges are known and solvable with the right strategy and partners.

Typical issues include:

- Unstable margins due to FX swings.

- Unexpected cross-border and scheme fees.

- Confusing checkout experiences when currencies change mid-journey.

- Chargebacks and disputes driven by unclear billing currencies.

- Operational headaches in reconciliation and accounting.

Recognizing these pain points early helps merchants design multi-currency payments for global stores that are resilient and scalable.

Managing Exchange Rate Volatility

Exchange rate volatility is one of the most visible risks for multi-currency payments for global stores. When currencies move quickly, merchants can see sudden changes in effective pricing and margins if they rely on direct FX conversions from a single base price.

There are several strategies to manage this:

- FX buffers: Add a small margin on top of mid-market rates to offset daily fluctuations.

- Rate caching: Update FX rates daily or weekly instead of in real time to stabilize prices, while monitoring exposure.

- Market-specific price lists: Set fixed local currency prices that are reviewed periodically, rather than constantly floating with FX.

- Hedging: For large, predictable volumes, use financial hedging instruments to lock in rates.

Industry guides suggest that FX and cross-border fees are major cost centers, so active management of FX strategy is essential. A thoughtful FX strategy makes multi-currency payments for global stores more predictable, allowing marketing and sales teams to craft promotions with confidence.

Communication is also key. Be transparent with customers about whether prices may change due to FX differences and how often. For most consumer-facing stores, keeping prices stable over reasonable periods is better than frequent minor adjustments that confuse shoppers.

Avoiding Hidden Fees, DCC Pitfalls, and Chargebacks

Hidden fees and confusing billing practices are a major source of frustration in cross-border ecommerce. If a customer sees one amount at checkout and a higher amount on their card statement due to FX and DCC markups, they may feel misled and dispute the transaction.

To avoid this, multi-currency payments for global stores should:

- Prefer multi-currency pricing over DCC whenever possible.

- Clearly communicate that customers will be billed in the currency shown at checkout.

- Work with providers that offer transparent FX rates and low, disclosed fees.

- Monitor support tickets for complaints about unexpected charges or FX fees.

Consumer-focused resources frequently warn shoppers against DCC because it often results in worse exchange rates than letting the card issuer handle conversion. For merchants focused on multi-currency payments for global stores, leaning on multi-currency pricing and ensuring consistent billing currencies is usually better for long-term trust.

Chargebacks can also spike if transaction descriptors are unclear in the customer’s language or if the billing currency doesn’t match what they remember from checkout.

Include your brand name and, when possible, the order reference in descriptors, and ensure that confirmation emails clearly restate the charged amount and currency. Clean, transparent practices reduce disputes and protect your chargeback ratios as you scale multi-currency payments for global stores.

The Future of Multi-Currency Payments for Global Stores

The future of multi-currency payments for global stores will be shaped by faster payment rails, AI-driven optimization, programmable money, and new types of digital currencies.

The cross-border payments market is enormous and growing, with estimates that global B2B cross-border payments will exceed tens of trillions of dollars in the coming decade. As more value moves across borders, competition and innovation among payment providers will intensify.

For global stores, this translates into more options for multi-currency payments, lower costs, and potentially new business models. At the same time, regulations, data protection rules, and expectations for transparency will continue to tighten, putting pressure on merchants and PSPs to maintain robust compliance and security.

AI, CBDCs, and Programmable Money

AI is already influencing multi-currency payments for global stores through risk scoring, routing optimization, and FX forecasting. Machine learning models can analyze patterns across millions of transactions to:

- Predict which acquirers and rails will yield the best authorization rates for each currency.

- Optimize the mix of local and cross-border acquiring for cost and reliability.

- Forecast FX movements and recommend hedging or pricing adjustments.

CBDCs and digital currency experiments are moving from theory to real-world pilots. Central banks and regional blocs are testing systems that allow instant cross-border transfers in digital fiat currencies, with lower costs and greater transparency.

Recent initiatives, including cross-border CBDC pilots and regional digital payment platforms that settle in local currencies, suggest that traditional reliance on a single reserve currency might gradually decline for some corridors.

Programmable money—funds that can carry embedded rules about where and how they can be used—could eventually enable multi-currency payments for global stores with automatic compliance checks, tax routing, and conditional payouts. For merchants, this might mean:

- Automated tax withholding and remittance in each jurisdiction.

- Instant payout to creators, sellers, or affiliates in their preferred currencies.

- Highly granular spending rules for corporate cards and wallets.

As these technologies mature, multi-currency payments for global stores will become more automated, efficient, and tailored to each stakeholder in the transaction.

Predictions for the Next 5–10 Years

Looking ahead, several trends are likely to define multi-currency payments for global stores:

- Multi-currency as default: As cross-border ecommerce continues to expand, multi-currency payments for global stores will become the assumed baseline. New platforms will launch with multi-currency and multi-method support out of the box, and merchants that do not offer localized currencies will struggle to compete.

- Near-real-time global settlement: Real-time domestic payment rails will increasingly interconnect, and stablecoin or tokenized deposit solutions will bridge gaps for cross-border settlement. This will reduce settlement delays, lower working capital requirements, and make multi-currency payouts more flexible.

- Smarter routing and FX optimization: AI will play a larger role in routing transactions, choosing FX sources, and balancing between settlement currencies. Multi-currency payments for global stores will feel increasingly “self-optimizing,” with merchants setting goals (e.g., maximize conversion or minimize fees) and systems adjusting routing automatically.

- Deeper localization beyond currency: Currency will be one part of a more comprehensive localization stack that also includes local payment methods, tax calculations, language, and content. Multi-currency payments for global stores will integrate tightly with localized logistics, returns, and support.

- Rising regulatory expectations: As volumes grow, regulators will continue to focus on cross-border flows, KYC/KYB standards, and consumer protections. Merchants will rely even more on PSPs and partners that can prove robust compliance, particularly around digital assets, stablecoins, and CBDCs.

For merchants today, the implication is clear: investing in multi-currency payments for global stores is not just about today’s conversion rates—it’s about building a future-ready infrastructure that can adapt to new rails, currencies, and regulations.

FAQs

Q.1: What is the difference between multi-currency payments and simply accepting international cards?

Answer: Many merchants start by “accepting international cards” without offering true multi-currency payments for global stores. This usually means that a store prices in a single currency, and international customers can pay using cards denominated in different currencies.

The card network and issuing bank then convert the transaction into the cardholder’s home currency, often applying FX fees and sometimes additional cross-border charges.

Multi-currency payments for global stores, by contrast, allow the store to price and bill directly in the customer’s local currency. The amount shown on the product page and checkout is the same currency and amount that appears on the customer’s statement, aside from any fees imposed by their bank.

The store or payment provider handles FX conversion on the back end, sometimes with better rates than consumer banks, and can choose when and how to convert funds into the merchant’s settlement currency.

The practical benefits are significant. With multi-currency payments for global stores, customers enjoy price transparency, reduced confusion, and fewer unpleasant surprises. They are less likely to abandon carts or dispute charges later.

Merchants gain better control over pricing and margins, and they can reduce cross-border fees by using local acquiring or optimized FX solutions. Accepting international cards is a good start, but multi-currency payments for global stores transform the experience into something truly localized and customer-centric.

Q.2: How many currencies should a global store support?

Answer: The ideal number of currencies for multi-currency payments for global stores depends on your current and target audience, operational capacity, and the capabilities of your payment providers.

Not every store needs to support dozens of currencies immediately. Instead, a phased approach tends to work best, starting with the largest or highest-potential markets.

Begin by reviewing where your traffic, signups, and demand originate. If you see significant traffic and interest from specific regions, prioritize those currencies first.

Adding those currencies to your multi-currency payments for global stores can unlock immediate conversion lifts and better customer satisfaction. Over time, monitor performance and expand currency support where you see growing demand or strategic opportunities.

Operationally, each new currency adds complexity to pricing, tax, and reconciliation. Multi-currency payments for global stores are easier to manage when you have robust reporting and finance tools in place.

Aim to align currency expansion with your ability to manage FX risk, local regulations, and accounting in those markets. For many merchants, starting with a core set of major currencies, then expanding to region-specific ones as needed, is a pragmatic path that balances customer experience with operational control.

Q.3: Do multi-currency payments increase or decrease my fees?

Answer: Multi-currency payments for global stores can both increase and decrease fees, depending on how they are implemented. On one hand, there may be additional costs from providers that handle multi-currency processing, FX conversion, and local acquiring.

On the other hand, a well-designed multi-currency strategy often reduces total cost per transaction by lowering cross-border fees, improving authorization rates, and allowing smarter FX management.

Traditional cross-border payments often involve multiple intermediaries and opaque FX spreads, leading to effective costs of several percentage points per transaction.

Multi-currency payments for global stores can reduce these costs by routing transactions through local acquirers, consolidating FX conversions at better wholesale rates, and minimizing unnecessary cross-border charges.

The net impact on fees ultimately depends on your provider contracts, transaction mix, and FX policies. To evaluate this, model scenarios comparing your current costs with a proposed multi-currency setup.

Include FX spreads, scheme and cross-border fees, and any incremental platform costs. In many cases, multi-currency payments for global stores deliver a positive ROI by combining cost savings with higher conversion and revenue, even if there are some new line items in the fee structure.

Q.4: How do I handle refunds and chargebacks in multiple currencies?

Answer: Refunds and chargebacks become more complex with multi-currency payments for global stores because they involve multiple currencies and exchange rates over time.

When a customer is charged in one currency and funds are settled or converted in another, any subsequent refund or chargeback must account for the original billing currency and the current FX rate.

Best practice is to always refund the customer in the same currency and amount they originally paid, subject to card network rules. Multi-currency payments for global stores should rely on payment providers that track original transaction currency, amount, and FX details so that refunds can be processed correctly.

From the customer’s perspective, they see a reversal in their own currency, which aligns with their expectations and reduces support issues.

For merchants, refunds and chargebacks can generate FX gains or losses if the settlement currency has moved relative to the billing currency between the time of sale and refund. Accounting systems must record these differences correctly.

Multi-currency payments for global stores should be integrated with accounting platforms that support FX revaluation and allocation of gains or losses to appropriate ledgers.

Chargebacks follow similar logic. When a dispute is raised, the scheme generally works in the billing currency, while your bank or PSP handles any FX conversions on your settlement side.

Good reporting tools make it easier to analyze chargebacks by currency and region, helping you refine your fraud rules and UX to reduce future disputes in your multi-currency payments for global stores.

Q.5: Are stablecoins or digital assets relevant for my store today?

Answer: Stablecoins and digital assets are still early-stage for most mainstream ecommerce use cases, but they are quickly becoming more relevant to multi-currency payments for global stores.

Stablecoins pegged to major fiat currencies can offer near-instant settlement, very low FX costs, and global accessibility, making them attractive for certain cross-border payout and settlement scenarios.

For many merchants, the first practical use cases are B2B-facing rather than consumer-facing. Examples include payouts to overseas sellers, vendors, or contractors, or funding local wallets in different currencies.

In these cases, stablecoins can serve as a bridge asset, with funds converted into local fiat currency at the endpoints. This can reduce reliance on traditional correspondent banking and cut settlement times from days to minutes.

Direct consumer payments in stablecoins are still a niche compared to cards and wallets, and regulatory frameworks continue to evolve. For now, most stores should treat stablecoins as an optional, future-oriented layer in their multi-currency payments for global stores, rather than a replacement for existing rails.

Keeping an eye on regulatory developments and PSP offerings will help you decide when, and how, to integrate stablecoin-powered features into your checkout or payout flows as demand and clarity grow.

Conclusion

Multi-currency payments for global stores are no longer just a technical feature—they are a strategic foundation for cross-border growth, brand localization, and long-term competitiveness.

By giving shoppers the ability to browse, pay, and receive refunds in their own currencies, merchants build trust, reduce friction, and unlock higher conversion rates and order values.

Behind the scenes, multi-currency payments for global stores depend on a well-structured stack: capable gateways, multi-region acquiring, FX and treasury tools, and robust fraud and compliance systems.

They also require thoughtful strategy around pricing, FX risk, tax, and analytics so that growth in international revenue translates into sustainable margins.

Looking ahead, multi-currency payments for global stores will increasingly tap into real-time payment networks, AI optimization, and emerging digital currency infrastructures like stablecoins and CBDCs.

These innovations promise faster, cheaper, and more programmable cross-border flows, but they will reward merchants who have already laid a strong multi-currency foundation.

If you want your store to thrive with international customers, start by making multi-currency payments for global stores a core part of your roadmap. Prioritize the highest-impact currencies and markets, choose partners that specialize in cross-border and multi-currency capabilities, and keep iterating on UX, pricing, and routing.

Done well, multi-currency payments for global stores can transform your business from a single-market seller into a truly global brand with loyal customers across borders.